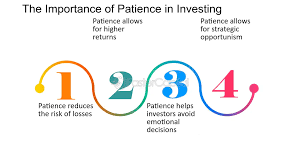

Achieving success in investing involves more than just market expertise or analytical ability. Patience is essential, especially during times of uncertainty. This quality is vital for long-term results, as it allows investors to ride out fluctuations and avoid impulsive choices that can undermine well-thought-out strategies. By understanding the value of patience, investors can remain disciplined and make more reasoned decisions.

Embracing a Long-Term Perspective

Wealth accumulation through investments is a process that unfolds over many years, and sometimes decades. Taking a long-term view is important for genuine financial growth. With this perspective, investors are able to focus on sustainable progress instead of quick, short-term gains. While daily news and global events can affect markets in the moment, historical patterns show that investment assets, including equities, tend to provide strong returns over extended periods. Patience serves as a core principle, helping investors stay committed to their goals even when short-term market swings might seem unsettling.

Avoiding Emotional Decisions

Managing emotions during volatile periods is one of the greatest challenges investors encounter. Allowing fear or greed to drive decisions—such as panic selling or impulsive buying—often leads to losses and disrupts carefully planned strategies. Patience supports thoughtful decision-making, giving investors the ability to calmly assess the situation and avoid avoidable mistakes. Maintaining a disciplined plan and a clear mind enables investors to weather both market highs and lows, boosting the likelihood of favorable long-term outcomes.

The Power of Compounding

Compounding serves as a fundamental engine for building wealth, and patience is necessary to realize its full benefits. When investors reinvest earnings, whether from dividends or interest, their gains increase over time. The longer investments remain in place, the more significant the effect of compounding becomes. This highlights the importance of starting early and remaining consistent. However, as James Chen, former director of investing content at Investopedia, points out, the effects of compounding can be negative when dealing with debt, making it important to approach this tool carefully.

Navigating Market Volatility

Financial markets are unpredictable by nature, and volatility is an ever-present factor. Investors who exercise patience are more likely to see this volatility as a normal aspect of investing rather than a source of fear. By staying informed, sticking with their strategies, and maintaining composure during downturns, patient investors can recover losses, find new opportunities, and benefit from eventual market rebounds. In contrast, impatience may result in hasty decisions, increased risk, and missed prospects for growth.

Staying Disciplined with Strategies

Successful investment plans are grounded in clear goals, careful diversification, and regular rebalancing. Each of these elements requires time to show results. Since strong returns are rarely achieved overnight, it is important to follow a defined strategy through varying market conditions. Discipline also involves avoiding the temptation to time the market or engage in speculative trading, as such actions frequently disrupt otherwise solid plans. Consistency and steady execution typically produce the strongest outcomes.

Marc Bistricer, founder of the Toronto-based investment firm Murchinson Toronto, stresses the importance of discipline in navigating the complexities of financial markets. Patience helps investors stay focused, adhere to their long-term strategies, and avoid emotional setbacks. By prioritizing long-term objectives and accepting market changes, patient investors give themselves the best chance for lasting success.